The wave of Digital India has now touched almost all aspects of our daily life. This aspect started working with full force with Demonetization.

Also, online money transactions come under the Digital India project concerning Demonetization. The aim is to make these transactions safe and paperless, probably taking the West as the model.

Besides, online payments or transfers are way more convenient than the hassle of first taking out the money, counting it, keeping it safe, and finally giving it to the concerned person. In the following article, we will learn about how PayPal work.

See Also: PayPal Check Cashing | Complete Guide On How To

What is Paypal?

Paypal is similar to Google Pay or Paytm; as you may know, the purpose of Google Pay and Paytm is almost the same, that is, for transferring money online with 2 to 3 clicks, but both are different in other aspects. Likewise, Paypal is meant for transferring money but is not the same as Google Pay, Paytm, or any other company that facilitates online transactions.

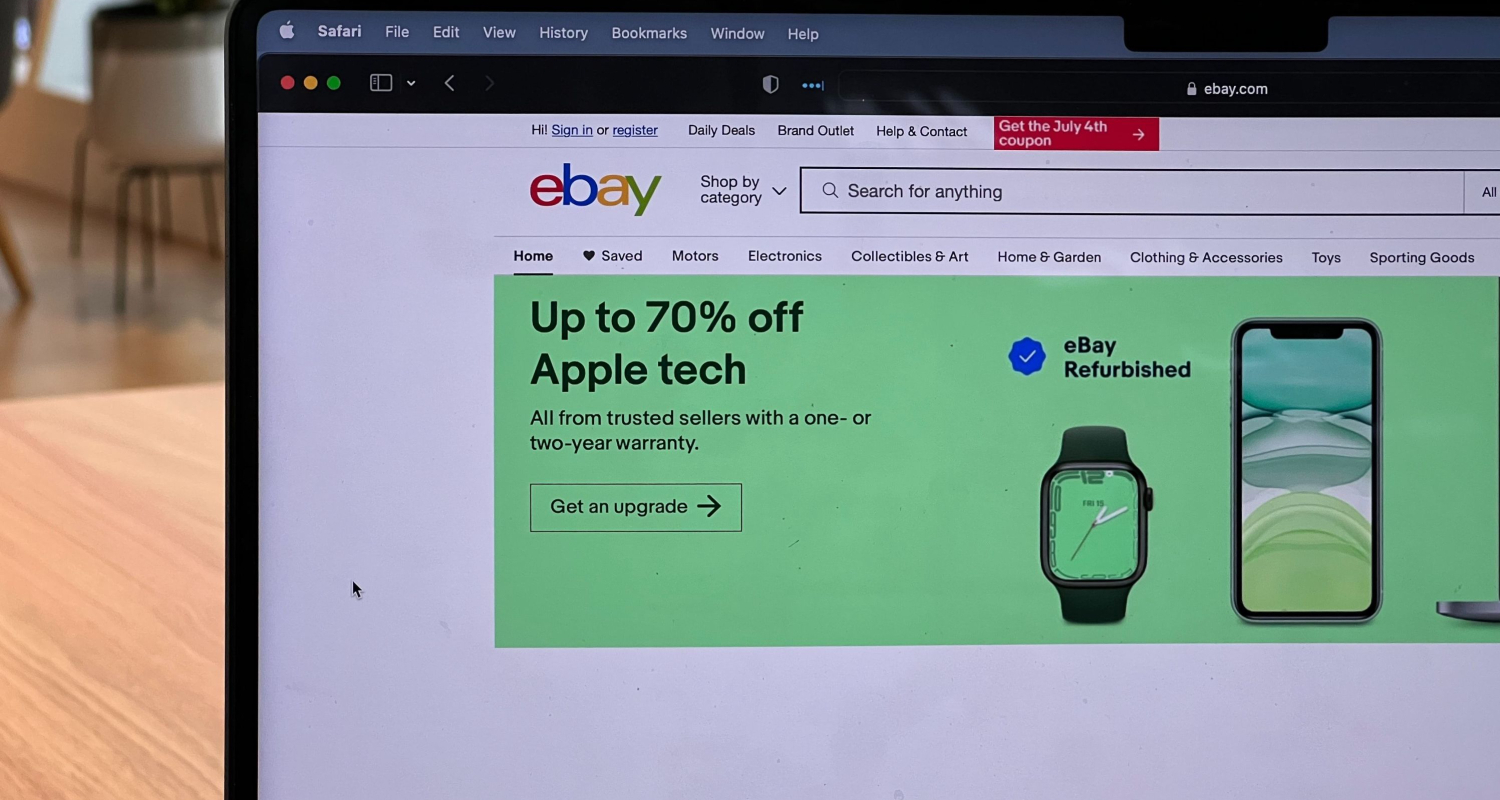

Unlike Paytm, which is an Indian association, Paypal is an American association. Much like Paytm, it is an excellent choice to maintain a strategic distance from the paper works identified with banking, like cheques. It works everywhere throughout the world. Sometimes, it charges a little expense from online dealers or different business customers due to giving them a single-tick payment process. Though developed in 1998, it sold its first stock in 2002. This sale of shares soon transformed it into an asserted assistant of eBay. It is among the top 250 revenue-procuring associations in the United States.

How does Paypal Work?

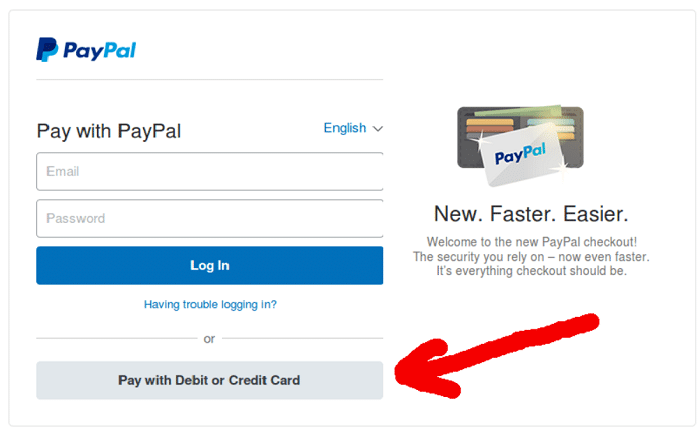

Using Paypal is not complicated, provided you know the basics. I will begin by telling you how PayPal works through the payment methods supported by Paypal.

Immediate Method

Under this, the money is credited to the beneficiary’s record instantly. The person or the organization you sent money to can promptly move the cash to their ledger or transfer it elsewhere.

This method will not work unless you have registered your card details (debit or credit) with PayPal beforehand. It is as secure as giving someone a cheque.

Electronic Cheque

In Paypal or the techie language, it is called “eCheck.” it works exactly like a genuine cheque, except its medium is electronic.

When you give someone an eCheck, it will take up to 4 days to get cleared. It eliminates the need to keep a backup.

When you give someone an eCheck, it will take up to 4 days to get cleared. It eliminates the need to keep a backup.

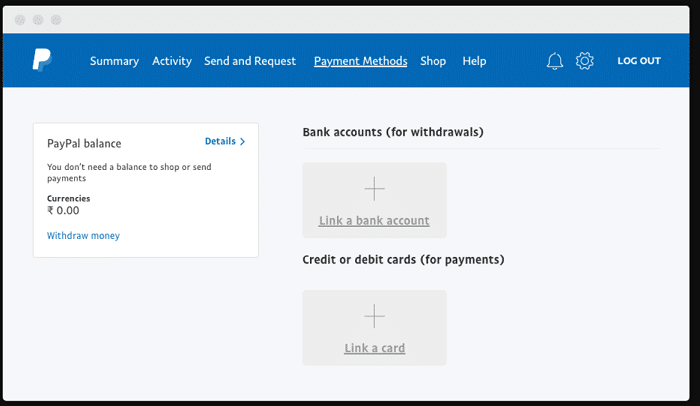

PayPal Wallet

Whenever someone sends you money from their Paypal wallet, you will receive it as Paypal money. And it will get added to the wallet. You will also get money in your wallet if you’ve sold something on eBay. You can purchase items using that money on eBay.

However, if you have no Paypal money, you can surely use the money in your account.

However, if you have no Paypal money, you can surely use the money in your account.

Card Payment

You can also pay directly by using your Credit Card. You must fill in your credit card details while paying to do so, in addition to the fact that PayPal ensures you. However, your Mastercard organization likewise has your back if you experience extortion.

Now I will explain to you how you might send contingent money.

You can pay for anything via Paypal if the beneficiary has an email address. Although “anything” has some exceptions. Here are the things that you cannot pay for:

- Anything that identifies or indicates betting.

- Adult content

- Medicines from unauthorized sources

Note – In case you intend to send installments for something that might be a bit shady, you better go through the Policy of Paypal for India or whichever country you live in carefully.

The initial step for sending the money is signing up. After doing that, click on the tab “Send Money.”

These are some of the best ways to understand how PayPal works.

See Also: Free PayPal Account Username and Passwords

How does PayPal money work for different purposes?

After learning the brief about the functioning of PayPal, through the following mentioned products, you can get a hack of how PayPal money work for serving different purposes and soothing your needs.

Products of eBay:

You must pay through the eBay Checkout framework when you purchase an eBay thing.

Products other than that of eBay:

The “radio button” is the key to sending money to stores or merchandise worldwide. This method does not work for eBay products.

Service Aids:

This method helps pay someone whose services you utilize. It may include florists, web developers, printouts, etc.

For this, you can use any payment methods that Paypal supports other than the one used to pay for eBay products.

For this, you can use any payment methods that Paypal supports other than the one used to pay for eBay products.

Personal Payments:

It has the heading of the point that suggests it is meant for your use. From buying a chocolate bar for your child to paying the can charge, it is helpful for every task when you forget to carry real cash.

These are some of the ways through which you can spend money through PayPal. Also, these ways will teach you well about how PayPal work.

These are some of the ways through which you can spend money through PayPal. Also, these ways will teach you well about how PayPal work.

FAQS

How do I receive money with PayPal?

When using Paypal, you can receive money when someone pays either your phone number or your email address from their PayPal wallet. Paypal generally sends you a notification after someone pays you on your account. You can then access the amount received from the home page on your PayPal account. Receiving and sending money, therefore, is a hassle-free process.

Does PayPal need a bank account?

No, you generally do not need a bank account for an account on Paypal. When signing up on Paypal, you are generally only asked for your name, mobile number, residential and email address. Your credit card number is also acceptable. Although most people do typically link their bank accounts for money withdrawals, it is actually not mandatory.

Is it free to use PayPal?

Paypal is generally free to use for online transactions. However, there are a few conditions. Only transactions with no currency conversion are free. Additionally, Paypal charges a percentage between 1.9 to 3.5 % for commercial transactions. Paypal’s transaction fees differ internationally and domestically. The fee rate per transaction generally depends on a price schedule for the receiving country’s currency.

What is the PayPal limit?

Paypal generally has a limit for transactions stated in USD. For personal Paypal accounts, the limit is USD 10,000 per transaction. The limit for a week is USD 60,000. Additionally, in case of business accounts, the monetary limit per transaction is USD 60,000 and $250,000 for a week. This measure is to reduce fraudulent money transfers.

Does Amazon accept PayPal?

Amazon generally does not accept PayPal for purchase payments directly. While you may not be able to pay directly on Amazon with your Paypal account, there are still various ways to pay with your Paypal money. For instance, you can pay at checkout using your Paypal debit and Business Mastercard. In both cases, the process is quick.

Conclusion

There are many rumors regarding online payment methods being unsafe. However, Paypal is an entirely secure app for money transactions. I hope you were able to learn how Paypal work.

See Also: How to Get a Free Dropbox Account

Gemma: Staff writer at FreeAccountsOnline, Journalism graduate from Leeds Beckett University. Covers breaking news, reviews, including world’s worst Steam games.